Exports to the majority of Singapore’s top markets fell, except for China. ST PHOTO: KUA CHEE SIONG

Published11 hours ago

More

Share

Tweet

Linkedin

Pin

Google+

Reddit

Print

Purchase Article

Permalink:

https://str.sg/JoNZ

Copy

Sue-Ann Tan suetan@sph.com.sg

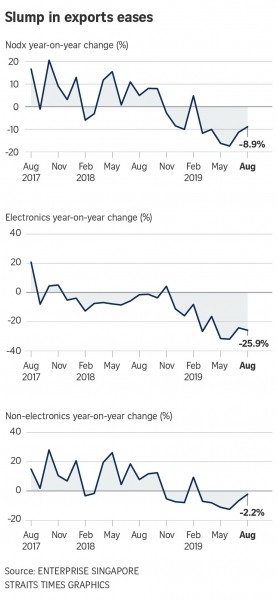

SINGAPORE – Singapore’s non-oil domestic exports (Nodx) fell 8.9 per cent in August from a year ago, breaking a five-month-long slump of double-digit declines, according to data out on Tuesday (Sept 17) by Enterprise Singapore.

This was also the second month in a row that the slide in shipments eased after they sank 17.4 per cent in June, the worst drop in six years. July’s number was revised to a fall of 11.4 per cent.

August’s drop was also not as steep as the 10.6 per cent fall predicted by experts polled by Bloomberg.

On a month-on-month seasonally adjusted basis, export figures rose by 6.7 per cent in August, after the preceding month’s 3.5 per cent increase.

CIMB Private Banking economist Song Seng Wun said the ease in export decline gives reason for cheer.

“There is still pressure on the export side but the rate of contraction might be starting to narrow. Our numbers are consistent with what we see around the world as well. It is some small cheer since the trade war started to escalate,” he said.

Electronic products drove the slump, declining by 25.9 per cent in exports last month, following the 24.2 per cent decrease in the previous month. ICs, PCs and disk media products contributed the most to the decline in electronic export numbers, Enterprise Singapore noted.

Non-electronic exports dipped by 2.2 per cent last month, an improvement from the 6.7 per cent decline in July. Pharmaceuticals contributed most to the drop, shrinking by 23.6 per cent, followed by petrochemicals and primary chemicals.

Exports to the majority of Singapore’s top markets fell, except for China. The largest contributors to the exports decline were Hong Kong, with exports falling 32 per cent, the United States at a 15 per cent drop and Malaysia, with a decline of 19.7 per cent.

Mr Song said: “There is a strong rebound in terms of exports to China, and it could be in the area of chemicals, non-electronics and food related items. But the drop in the US figures shows that they may have pulled back and is perhaps a sign that the trade fight is having some impact there.”

He added that the next round of trade talks and other issues such as heightened tension in the Middle East will be important in affecting future export numbers.

“It all depends on how long the oil trade disruption will last. We could see oil trade prices spiking during these few months and then it becomes a case of whether confidence will be shaken. Geopolitical risks can weigh on consumer confidence.”

Last month, Enterprise Singapore slashed its Nodx forecast to -9 to -8 per cent for the year, down from the range of -2 to 0 per cent which was revised in the first quarter.

This was on the back of exports sinking by double digits in the second quarter, contracting by 14.6 per cent compared with a year ago.

This is a much steeper fall compared with the 6.4 per cent drop seen in the first quarter, and is Singapore’s third straight quarter of Nodx decline.